Mastering Game Stocks: A Comhensive Guide to Investing in the Gaming Industry

Content:

Investing in the gaming industry, also known as game stocks, can be a lucrative opportunity for those who understand the market dynamics. However, it’s essential to ask the right questions and gather sufficient information before diving in. Below are some key inquiries that can help you navigate this sector effectively.

Possible Questions to Consider

1. What are game stocks, and how do they differ from traditional stocks?

2. Which companies are the top players in the gaming industry, and why should I invest in them?

3. What factors influence the performance of game stocks?

4. Are there any risks associated with investing in game stocks?

5. How can I build a diversified portfolio that includes game stocks?

Understanding Game Stocks

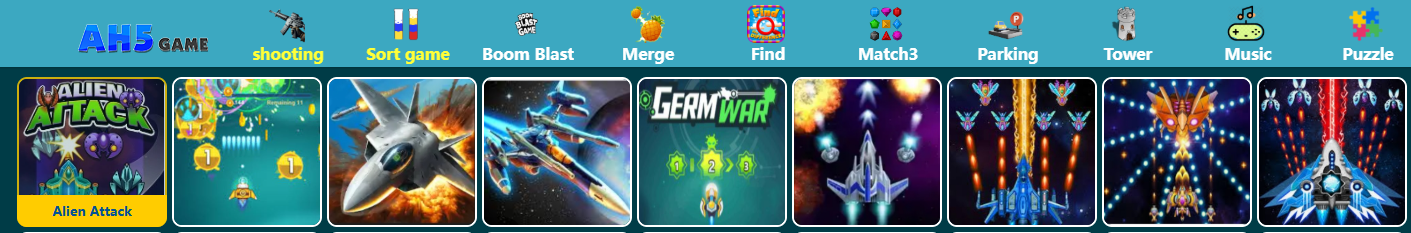

Game stocks refer to shares of publicly traded companies involved in the gaming industry, including video game publishers, console manufacturers, and gaming accessory providers. Unlike traditional stocks, this sector is highly influenced by trends in gaming hardware, software, and consumer ferences.

Top Companies in the Gaming Industry

ns a favorite among investors for its iconic franchises like Mario and Zelda. These companies often see their stock values rise with new game releases or hardware innovations.

Factors Influencing Game Stock Performance

Several factors can impact the performance of game stocks. Market analysts often consider:

Sales of new games and hardware

Subscription services (e.g., Xbox Game Pass, PlayStation Plus)

Economic conditions affecting consumer spending

Technological advancements (e.g., VR, cloud gaming)

Risks Involved in Investing in Game Stocks

While the gaming industry offers growth potential, it’s not without risks. Market volatility, competition from emerging platforms, and dependency on consumer trends can all affect stock prices. Investors should conduct thorough research and consider their risk tolerance before investing.

Building a Diversified Portfolio with Game Stocks

r gaming stocks with tech and consumer goods companies to balance growth and stability. Here’s a sample portfolio approach:

60% Technology stocks (including gaming companies)

30% Consumer goods (e.g., gaming accessories)

10% Healthcare or utilities (for stability)

Sharing Insights: A RealWorld Example

d off, as the gaming industry continued to expand despite economic fluctuations.

Conclusion

Investing in game stocks can be rewarding, but it requires careful analysis and a wellthoughtout strategy. By understanding the market, key players, and potential risks, you can make informed decisions and capitalize on the growing gaming industry. Whether you’re a seasoned investor or new to the market, game stocks offer a unique opportunity to tap into a dynamic and expanding sector.